Locate the Best Homeowner's Insurance in Atlanta Georgia Today

Top House Insurance Coverage Firm in Metro Atlanta

Your home is your haven, as well as you wish to do everything you can to secure it. Look At This Piece 's where locating the ideal home insurance firm enters into play. If you're in the City Atlanta area, you could be asking yourself which agency best fits you. Look no further than White Oak Insurance Coverage Solutions. As the top choice for property owners, their team of experts can assist you compare up to 20 quotes in one telephone call as well as find the excellent policy to fit your requirements. Yet what sets White Oak aside from various other firms? In this blog post, we'll explore just how they can aid homeowners and renters, as well as we'll dive into various residence insurance coverage classifications and also compare Allstate and USAA for residence insurance in Georgia. And also, we'll provide pointers on selecting the ideal plan for you and respond to some frequently asked questions concerning house insurance in Georgia.

Finest House Insurance Coverage Firm in Metro Atlanta

The most effective House owner's Insurance policy Firm in Atlanta is White Oak Insurance Providers. Offering up to 20 quotes from the top insurance provider in one telephone call, you can compare as well as discover the very best policy for your home rapidly and easily. And also, with their experience in helping property owners throughout City Atlanta, they understand what it requires to obtain you the protection you need at a cost that fits your budget plan. Their educated staff is ready to help, so call them today. Many thanks for considering White Oak Insurance Providers for your home insurance policy requires in Metro Atlanta!

Why White Oak Insurance Policy Solutions is the Leading Selection for House Owners

When picking the best home insurance policy, finding an insurance company who comprehends your unique requirements is essential. This is where White Oak Insurance Services stands out from various other insurance companies in Metro Atlanta. With years of experience in the insurance policy market, they supply a tailored strategy to help house owners discover the ideal suitable for their specific scenario. White Oak Insurance coverage Solutions supplies superb coverage choices and automobile, life, and also occupants insurance coverage. They work with different trustworthy insurance coverage providers, so you can have comfort understanding you're getting the very best protection at an economical cost.

Contrast as much as 20 Residence Insurance Coverage Quotes in One Call

When looking for the ideal home insurance plan, comparing as much as 20 home insurance policy quotes in one phone call is vital. To find the best insurance coverage as well as rates, collaborate with a trusted agency in Metro Atlanta, like White Oak Insurance Coverage Solutions or State Farm, that provides tailored attention and specialist guidance on different coverage choices, including flood insurance or endorsement plans. Take into consideration getting in touch with regional agents who can describe exactly how car or life insurance policy policies might complement your homeowner's insurance. Always examine if the insurer gives loss of use payment in case of all-natural disasters or burglary.

What Sets White Oak Insurance Providers In Addition To Other Agencies?

White Oak Insurance policy Providers stands apart from various other firms by offering customized insurance coverage options that cater to each client's special needs. Their group of experienced professionals supplies personalized service and also works with various insurance carriers to supply comprehensive insurance coverage options. The company prioritizes openness, honesty, and also integrity in all customer interactions.

The Relevance of Residence Insurance Coverage for Georgia Homeowners

Home owners in Georgia need the ideal insurance coverage to shield their residences from injury. Residence insurance plan offer economic protection versus all-natural calamities, burglary, and also other unforeseen events that can potentially harm or damage your residence. White Oak Insurance coverage Services is one of the best selections for home owners in City Atlanta. This insurance agency partners with numerous insurance policy carriers to provide the most effective protection options at affordable prices. With years of experience in the sector, they use customized solution tailored to private demands, ensuring excellent customer contentment. Did you understand that White Oak Insurance coverage Solutions likewise provides tenants' insurance coverage, automobile insurance, life insurance policy, small business insurance policy, flood insurance, and also extra? With exceptional service, budget-friendly costs, and also professional recommendations on the right fit, White Oak Insurance Coverage Solutions is the best option for all your insurance policy needs.

How White Oak Insurance Policy Solutions Can Help Tenants

White Oak Insurance Services is a top selection when locating the appropriate insurance plan for an occupant. They recognize that occupants may not see the very same demand for insurance coverage as home owners do, however they're devoted to informing customers about the value of insurance coverage. With individualized service and also accessibility to over 25 different insurance carriers, White Oak Insurance coverage Providers can help occupants discover the right suitable for their indiv. Their experienced agents give superb solution as well as are constantly all set to answer concerns or deal specialist suggestions. Whether you're seeking personal effects or responsibility protection coverage, White Oak Insurance coverage Services has actually got you covered.

Understanding Different Home Insurance Coverage Designations

Home Insurance Coverage: Understanding Various Classifications

Concerning homeowner's insurance policies, different classifications are offered to satisfy your certain requirements. These include typical home owners' insurance coverages that cover damages to the home as well as personal effects with included obligation protection as well as living expenses insurance coverage; high-value residence insurance perfect for high-end houses with high-value properties; condo insurance policies that supply personal effects and also liability security for condominium owners; renters' insurance coverages that give protection versus theft, all-natural disasters or loss of use; and much more such as flooding insurance policies giving insurance coverage against damages caused by floodings not covered under basic house owners' plans. As a credible insurer with years of experience offering homeowners in Metro Atlanta, our professional advice will certainly direct you in choosing the ideal fit for your needs.

What is HO-1 Coverage?

HO-1 Coverage is an important residence insurance coverage that covers certain called risks like fire, theft, as well as criminal damage. While it's not frequently offered anymore, it might be an alternative for those with older residences or restricted budgets. Nonetheless, examining policy details as well as restrictions is critical before picking HO-1 insurance coverage. Consulting with an insurance coverage representative can assist in establishing the most effective protection alternatives for your needs.

What is HO-2 Insurance coverage?

HO-2 protection is a house insurance coverage that shields property owners against particular dangers, including fire, burglary, as well as criminal damage, and also might consist of natural calamities. It's a more cost effective choice but uses minimal protection. It's essential to examine the policy meticulously as well as seek aid from an insurance coverage agent to guarantee it meets your requirements.

What is HO-3 Protection?

HO-3 protection is a preferred home insurance plan that safeguards your residential property and also belongings versus various hazards, like fire, theft, as well as water damages. It's called a "unique form" policy given that it covers all dangers other than those expressly omitted. Responsibility protection is generally included for injuries and also problems caused by you or your residential property. Evaluation the policy details carefully and also seek advice from an expert agent for customized protection.

What is HO-4 Coverage?

HO-4 coverage, or occupant's insurance coverage, safeguards the personal effects against burglary, damages, or destruction caused by protected events. It likewise shields obligation if a person is hurt while seeing your rented out residential or commercial property. Nonetheless, it does not cover the structure of the rental property. Guarantee your plan has enough protection for your belongings.

Variables that Influence Your Residence Insurance Rates

The expense of your house insurance policy depends upon various factors such as area, age and problem of your residence, protection quantity, as well as insurance deductible you select. Homes vulnerable to natural calamities or high criminal offense prices may have greater insurance policy prices. Older houses or those in bad problem may additionally lead to higher premiums. Picking appropriate coverage choices for individual demands is essential after getting in touch with a seasoned insurance policy representative with years of experience handling numerous sorts of plans from multiple insurance firms.

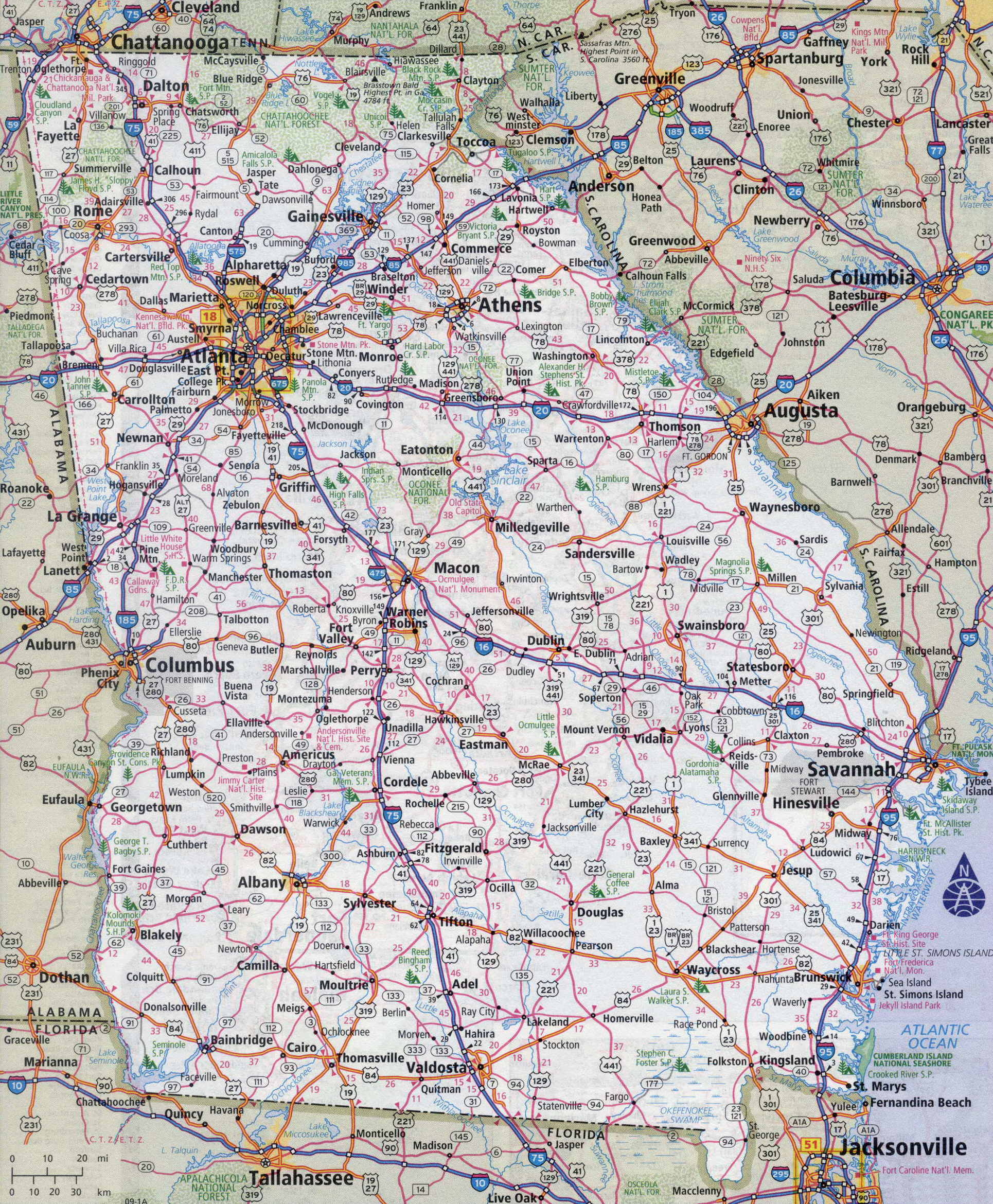

Location and also Regional Threats

When picking homeowners insurance policies in Georgia, it's important to consider place and local dangers. Criminal offense rates, proximity to emergency situation services, and direct exposure to all-natural calamities can all affect your insurance policy costs. Recognizing these particular dangers is vital and also dealing with local representatives from reliable insurance provider that offer professional recommendations on the ideal fit for your private requirements. Adding safety and security functions like alarm systems and cams can help in reducing your costs while ensuring you have the most effective protection alternatives.

Age and Condition of the House

The age and also condition of a house are essential determinants of house owners' insurance coverage rates. A house with out-of-date electric or plumbing systems or structural concerns is much more pricey to insure. In addition, if it sustains more damage from accidents or natural catastrophes, it is also at greater danger. Updating your house's systems and maintaining its overall condition can assist you obtain budget-friendly rates for your house insurance policy. Keep reviewing policies to match certain requirements.

Credit History as well as Insurance Rating

Your credit score and also insurance scores are crucial in identifying your home insurance coverage prices. Insurance companies utilize them to calculate the level of danger you pose as a guaranteed individual. Improving your credit rating as well as insurance rating can assist you get the most effective protection at inexpensive rates. Get in touch with trusted regional agents today for expert recommendations on securing the appropriate coverage alternatives from the very best home insurance companies in Metro Atlanta and also past.

The Typical Price of Homeowners Insurance Policy in Georgia

The average expense of house owners insurance policy in Georgia is $1,267 each year. Numerous aspects can impact your costs, such as your home's age and also problem, area, and protection options. To get the best protection at an inexpensive price, you can contrast quotes from numerous insurance policy agencies. In addition, dealing with a top-rated house insurance coverage agency in metro Atlanta that provides skilled recommendations and also superb client service is essential. Doing so offers you access to various policy options customized to your private needs.

Our Price Technique for Determining Average Rates

Countless factors have to be thought about when establishing the ordinary expense of house owners insurance policy in City Atlanta. These include deductibles, insurance coverage limits, age and condition of your house, area, and also protection alternatives. To discover inexpensive rates, looking around and also comparing quotes from different insurance provider is vital. Partnering with a highly-rated home insurance coverage agency like White Oak Insurance coverage Solutions provides tailored service and a range of plan choices for home owners' privacy.

Contrasting Allstate as well as USAA for Residence Insurance in Georgia

When selecting an insurance policy supplier to contrast quotes for house insurance coverage in Georgia, it is important to think about a few elements. These consist of evaluating the coverage choices provided by carriers like Allstate and also USAA, as well as considering their rates and also discount rates available. You need to likewise consider the customer support ratings as well as evaluations they've received from other property owners in your location and examine their economic toughness and security. Choosing an ideal service provider can supply outstanding service at a cost effective cost while ensuring your residence is effectively covered.

Which Company Supplies Better Insurance Coverage for Georgia Homeowners?

Allstate and USAA are top insurance provider in Georgia, using numerous protection choices for property owners, including residence protection, personal property, as well as responsibility. Allstate has a solid monetary ranking, while USAA boasts superb customer support. Nonetheless, the choice ultimately depends upon specific needs, spending plan, as well as elements like deductibles and also limitations.

What Sets USAA Besides Various Other Residence Insurance Coverage Providers?

USAA stands apart from other house insurance coverage providers by accommodating armed forces participants and also their family members with specialized protection choices, getting high scores for customer fulfillment as well as monetary strength. They use one-of-a-kind attributes like replacement expense insurance coverage, identification theft defense, uniform military insurance coverage, discounts for secure houses, packed plans, as well as excellent trainees.

Tips for Choosing the Right Residence Insurance Coverage

When picking a home insurance plan, it is very important to comply with expert recommendations for an educated choice. Develop the insurance coverage you require based upon your property's worth and contents in Georgia's Metro Atlanta area. Next off, look for plans that offer flexible deductible options as well as take into consideration packing house insurance policy with various other types of insurance coverage to use extra price cuts. Looking into an insurance company's monetary security as well as credibility is critical prior to making decisions. Last but not least, get quotes from various providers to secure the most effective property owners' insurance policy coverage readily available at budget-friendly prices.

Recognizing Policy Restrictions and Deductibles

House insurance plan, plan restrictions, and also deductibles are essential elements that homeowners need to think about. Plan limits describe the maximum amount an insurance firm pays out in case of a claim. Deductibles are the amount you pay out of pocket before your insurance coverage starts. While higher policy limitations offer far better coverage alternatives, it brings about greater costs. Selecting a greater deductible might reduce your premium however causes even more out-of-pocket costs for you. For that reason, understanding your plan limitations and deductibles is vital when discovering the appropriate suitable for your requirements.

Secondary key terms used: car insurance coverage, home owner, Georgia, home owners insurance, home insurance coverage, insurer, Atlanta, tenants insurance coverage, personal property, an insurance company.

Contrasting Quotes from Several Companies Before Choosing

When contrasting quotes from several insurance policy companies, numerous factors have to be considered. These include deductibles, insurance coverage limitations, as well as exclusions. In addition, you ought to inquire about offered discounts and also collaborate with an independent insurance policy agent that has accessibility to various insurance providers for honest advice. It's vital to remember that the lowest-priced plan may not constantly supply the best protection. We recommend picking a plan that effectively secures your residential or commercial property, belongings, and also obligation demands.

Frequently Asked Questions about Home Insurance Policy in Georgia

If you're a property owner in Georgia, you may question the different house insurance protection kinds readily available. It's likewise typical to ask how much protection you require and what elements impact your costs. The good news is, a skilled insurance policy agent can give expert recommendations on these concerns and even more.

By working with an educated insurance provider, you can locate the appropriate policy that uses the most effective protection choices for your personal property as well as financial protection. Additionally, a skilled insurer can aid with any type of insurance claims on your policy and also aid you discover cost effective pricing for your home insurance needs. Do not think twice to contact a top-rated insurance firm like White Oak Insurance coverage Solutions today for specialist assistance.

Final thought

To conclude, your home is just one of the most significant investments you'll ever make. Selecting the ideal insurance plan to shield your financial investment is crucial. With many choices, it can be frustrating to choose the best one. That's why it's important to partner with a trusted insurance policy company that comprehends your demands as well as has your best interests at heart. Our house insurance policy firm in Metro Atlanta provides customized insurance policy solutions that fit your unique demands. Call us today and experience satisfaction knowing that the top house insurance firm in City Atlanta covers you.